Economy:

Dominica’s currency is the East Caribbean Dollar. In 2008, Dominica had one of the lowest per capita gross domestic product (GDP) rates of Eastern Caribbean states. The country nearly had a financial crisis in 2003 and 2004, but Dominica’s economy grew by 3.5% in 2005 and 4.0% in 2006, following a decade of poor performance. Growth in 2006 was attributed to gains in tourism, construction, offshore and other services, and some sub-sectors of the banana industry. Around this time the International Monetary Fund (IMF) praised the Government of Dominica for its successful macroeconomic reforms, but also pointed out remaining challenges, including the need for further reductions in public debt, increased financial sector regulation, and market diversification.

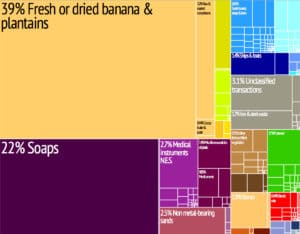

Agriculture and especially bananas once dominated Dominica’s economy, and nearly one-third of the labor force worked in agriculture in the early 2000s. This sector, however, is highly vulnerable to weather conditions and to external events affecting commodity prices. In 2007, Hurricane Dean caused significant damage to the agricultural sector as well as the country’s infrastructure, especially roads. In response to reduced European Union (EU) trade preferences for bananas from the former European colonies after the 2009 WTO decision, the government has diversified the agricultural sector by promoting the production of coffee, patchouli, aloe vera, cut flowers, and exotic fruits such as mango, guava and papaya, while the economy has become increasingly dependent on tourism.

Dominica is a beneficiary of the Caribbean Basin Initiative (CBI) that grants duty-free entry into the United States for many goods. Dominica also belongs to the predominantly English-speaking Caribbean Community (CARICOM), the CARICOM Single Market and Economy (CSME), and the Organisation of Eastern Caribbean States (OECS).

The Commonwealth of Dominica is becoming in recent years a major international financial center. The largest sectors are “offshore banking, payment processing companies, and general corporate activities”. Regulation and supervision of the financial services industry is the responsibility of the Financial Service Unit of the Commonwealth of Dominica (FSU) under the supervision of the Ministry of Finance. There are a number of service providers. These include global financial institutions including Scotiabank, Royal Bank of Canada, Cathedral Investment Bank, First Caribbean International Bank, and The Interoceanic Bank of the Caribbean.

Starting in the mid-late 1990s, offshore financial centers, such as the Commonwealth of Dominica, came under increasing pressure from the OECD for their allegedly harmful tax regimes, where the OECD wished to prevent low-tax regimes from having an advantage in the global marketplace. The OECD threatened to place the Commonwealth of Dominica and other financial centers on a “black list” and impose sanctions against them. However, the Commonwealth of Dominica successfully avoided being placed on the OECD black list by committing to regulatory reform to improve transparency and begin information exchange with OECD member countries about their citizens.

Dominica supposedly offers tax-free status to companies relocating from abroad. It is not known how many companies benefit from the tax-free status because of the strict confidentiality the government enforces, although it is known many Internet businesses and hedge funds utilize Dominica for this reason. However, on 12 July 2012 Dominica signed an agreement with Poland to exchange tax information.